Why Biden Ended discover student loans Relief

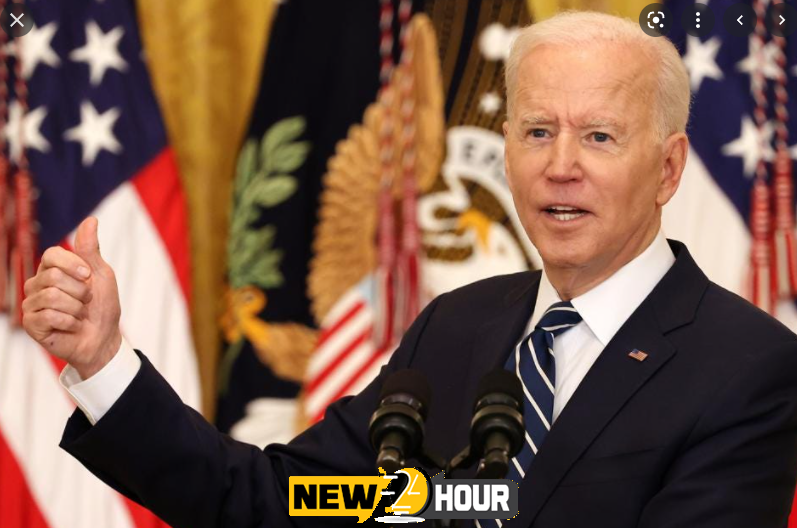

Here’s why President Joe Biden terminated student debt forgiveness.

What you need to know — and what it implications for your discover student loans — is outlined below.

This week, discover student loans President Joe Biden made it official: temporary student debt relief will cease, and federal student loan payments will resume on February 1, 2022. That may come as a surprise to at least some of the 40+ million student loan borrowers affected by the ruling. (No, Biden will not renew student loan relief.) Here’s why Biden made his choice.

more articles : NBA Mailbag How long will Stephen Curry reign supreme as the 3-point king?

1. Student loan debtors received 22 months of loan forgiveness.

In response to the Covid-19 epidemic, student loan debtors have received extraordinary student loan relief from March 2020. The Cares Act, a $2.2 trillion stimulus package enacted by Congress, includes considerable student debt relief for federal student loan holders. Among other things, student loan debtors were not forced to make any federal student loan payments, interest rates on federal discover student loans were lowered to 0%, and collection of student loan debt for students in default was suspended. This historic student debt relief was enacted by Congress for six months, but President Donald Trump extended it twice until January 31, 2021 by executive action. This student debt reduction was also extended twice by Biden until January 31, 2022, when it would expire after almost two years. 5 of the worst things you can do for your student debt.

2. Borrowers of discover student loans will get more than $110 billion in debt cancellations.

It’s no secret that members of Congress, especially Senate Majority Leader Chuck Schumer (D-NY) and Senator Elizabeth Warren (D-MA), have been spearheading the charge to urge President Barack Obama to cancel discover student loans on a large scale. They want to cancel up to $50,000 in student loan debt for borrowers, while others want to eliminate all $1.7 trillion in student loan debt. (A list of everyone who wants Biden to prolong student debt relief is available here.) Regardless of these recommendations, it’s worth noting that student loan deferment as a consequence of the Covid-19 outbreak led in more over $110 billion in student debt cancellation for borrowers. According to the United States Department of Education, this corresponds to about $5 billion in interest savings every month for the next 22 months. With $110 billion in student debt forgiveness available via this student loan relief programme, Biden may decide it’s time to turn off the flow.

3. Biden has forgiven $12.5 billion in student debt.

Biden has forgiven $12.5 billion in student debts since taking office in January. (How to Be Eligible for Automatic Student Loan Forgiveness) This is in addition to the $110 billion in student debt forgiveness as a result of the Covid-19 epidemic. Among others, Biden has forgiven student debts for public employees, borrowers with complete and permanent disabilities, and borrowers who were mislead by their institution or university. There are five ways Biden may cancel additional student debts. Biden has also proposed significant improvements to student debt forgiveness, which will allow more students to have their loans erased. Some may argue that these improvements might occur without the extension of student debt relief. However, when paired with student debt cancellation from the Cares Act, Biden is sending the message that borrowers have received significant student loan relief, which Biden believes makes it appropriate to discontinue student loan relief in January. This is not to say that there will be no more student debt forgiveness — there will be — but it will not be accessible to the majority of student loan borrowers as it is now under this temporary student loan forbearance. (Here’s how to receive student debt forgiveness during Biden’s presidency.) Some anticipate Biden to cancel student debts before the end of student loan relief next month, others don’t expect Biden to cancel discover student loans before the end of student loan relief.

4. Aside from student debt forgiveness, there are other economic objectives.

As president, Biden is responsible for the whole country. There are 45 million student loan debtors, accounting for around 14% of the approximately 330 million Americans. Extending student debt relief, according to student loan borrowers and supporters, is a financial need that would boost the economy, eliminate inequities, and assist student loan borrowers in paying bills, getting married, starting a family, and saving for a house and retirement. All of these are critical concerns for a president to handle. At the same time, Biden must strike a balance between the plight of student loan borrowers and the plight of other Americans, as well as other economic priorities such as combating inflation, controlling the Covid-19 pandemic and the emergence of the Omicron variant, rebuilding the economy, and considering additional stimulus, among others. Reasonable minds may dispute the relative significance of these objectives, but they exist, and the president must find a way to balance them in order to meet the economic requirements of all Americans.

The basic truth is that your federal student loan payments will begin in less than six weeks. You may agree or disagree with the choice, but make sure you are aware of all your repayment alternatives for discover student loans. Here are some common methods for lowering your student loan payments:

- Refinancing a student loan (lower interest rate + lower monthly payment)

- Repayment arrangements based on income (lower payment, but same interest rate)

- Loan forgiveness for government employees (student loan forgiveness for public servants)